-

Join ccmfans.net

ccmfans.net is the Central Coast Mariners fan community, and was formed in 2004, so basically the beginning of time for the Mariners. Things have changed a lot over the years, but one thing has remained constant and that is our love of the Mariners. People come and go, some like to post a lot and others just like to read. It's up to you how you participate in the community!

If you want to get rid of this message, simply click on Join Now or head over to https://www.ccmfans.net/community/register/ to join the community! It only takes a few minutes, and joining will let you post your thoughts and opinions on all things Mariners, Football, and whatever else pops into your mind. If posting is not your thing, you can interact in other ways, including voting on polls, and unlock options only available to community members.

ccmfans.net is not only for Mariners fans either. Most of us are bonded by our support for the Mariners, but if you are a fan of another club (except the Scum, come on, we need some standards), feel free to join and get into some banter.

You should upgrade or use an alternative browser.

...as seen on the Internet

- Thread starter dibo

- Start date

VicMariner

Well-Known Member

A physicist friend of mine worked out a 100% reliable system for predicting horse race results....

....but it only works for spherical horses racing in a vacuum.

priorpeter

Well-Known Member

https://twitter.com/mrlukejohnston/status/795609403789635584

Wombat

Well-Known Member

This man is my hero:

Hmmm maybe better than Ian Ballard of North Sydney FC. Undefeated slurpper of Sydney in my day.

Full yard in less than 5 secs.

Pint in 1 sec.

dibo

Well-Known Member

VicMariner

Well-Known Member

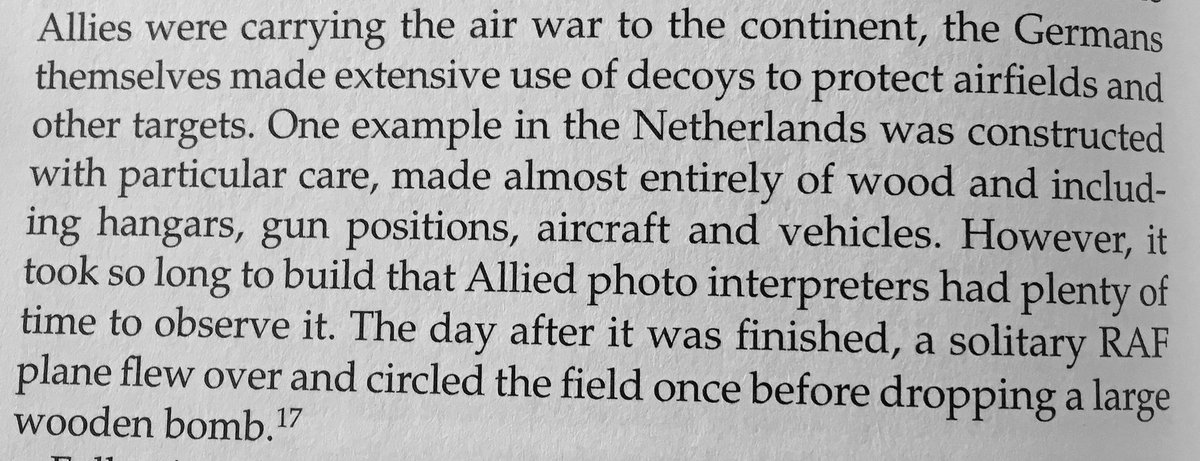

The Germans are (usually) only stupid in movies.

"we can't find reason to classify it as anything but fictional."

http://www.snopes.com/military/woodbomb.asp

dibo

Well-Known Member

Yeah, that's fair enough. Funny story though.Probably never happened.

The Germans are (usually) only stupid in movies.

"we can't find reason to classify it as anything but fictional."

http://www.snopes.com/military/woodbomb.asp

midfielder

Well-Known Member

midfielder

Well-Known Member

sydmariner

Well-Known Member

dibo

Well-Known Member

Image: Vitaly

Scott Santens

Consider for a moment that from this day forward, on the first day of every month, around $1,000 is deposited into your bank account — because you are a citizen. This income is independent of every other source of income and guarantees you a monthly starting salary above the poverty line for the rest of your life.

What do you do? Possibly of more importance, what don’t you do? How does this firm foundation of economic security and positive freedom affect your present and future decisions, from the work you choose to the relationships you maintain, to the risks you take?

The idea is called unconditional or universal basic income, or UBI. It’s like social security for all, and it’s taking root within minds around the world and across the entire political spectrum, for a multitude of converging reasons. Rising inequality, decades of stagnant wages, the transformation of lifelong careers into sub-hourly tasks, exponentially advancing technology like robots and deep neural networks increasingly capable of replacing potentially half of all human labour, world-changing events like Brexit and the election of Donald Trump — all of these and more are pointing to the need to start permanently guaranteeing everyone at least some income.

A promise of equal opportunity

“Basic income” would be an amount sufficient to secure basic needs as a permanent earnings floor no one could fall beneath, and would replace many of today’s temporary benefits, which are given only in case of emergency, and/or only to those who successfully pass the applied qualification tests. UBI would be a promise of equal opportunity, not equal outcome, a new starting line set above the poverty line.

It may surprise you to learn that a partial UBI has already existed in Alaska since 1982, and that a version of basic income was experimentally tested in the United States in the 1970s. The same is true in Canada, where the town of Dauphin managed to eliminate poverty for five years. Full UBI experiments have been done more recently in places such as Namibia, Indiaand Brazil. Other countries are following suit: Finland, the Netherlands and Canada are carrying out government-funded experiments to compare against existing programmes. Organizations like Y Combinator and GiveDirectly have launched privately funded experiments in the US and East Africa respectively.

I know what you’re thinking. It’s the same thing most people think when they’re new to the idea. Giving money to everyone for doing nothing? That sounds both incredibly expensive and a great way to encourage people to do nothing. Well, it may sound counter-intuitive, but the exact opposite is true on both accounts. What’s incredibly expensive is not having basic income, and what really motivates people to work is, on one hand, not taking money away from them for working, and on the other hand, not actually about money at all.

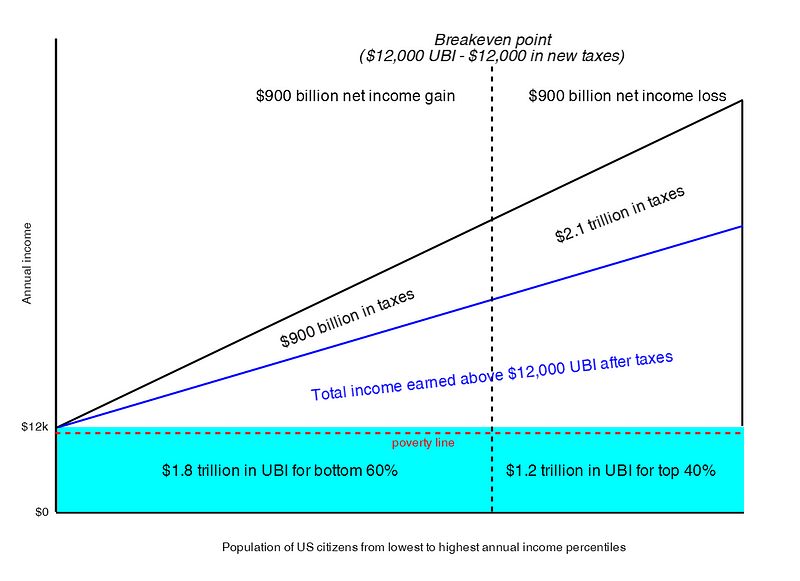

Basic income in numbers

What tends to go unrealized about the idea of basic income, and this is true even of many economists — but not all — is that it represents a net transfer. In the same way it does not cost $20 to give someone $20 in exchange for $10, it does not cost $3 trillion to give every adult citizen $12,000 and every child $4,000, when every household will be paying varying amounts of taxes in exchange for their UBI. Instead it will cost around 30% of that, or about $900 billion, and that’s before the full or partial consolidation of other programmes and tax credits immediately made redundant by the new transfer. In other words, for someone whose taxes go up $4,000 to pay for $12,000 in UBI, the cost to give that person UBI is $8,000, not $12,000, and it’s coming from someone else whose taxes went up $20,000 to pay for their own $12,000. However, even that’s not entirely accurate, because the consolidation of the safety net and tax code UBI allows could drive the total price even lower.

Now, this idea of replacing existing programmes can scare some just as it appeals to others, but the choice is not all or nothing: partial consolidation is possible. As an example of partial consolidation, because most seniors already effectively have a basic income through social security, they could either choose between the two, or a percentage of their social security could be converted into basic income. Either way, no senior would earn a penny less than now in total, and yet the UBI price tag could be reduced by about $220 billion. Meanwhile, just a few examples of existing revenue that could and arguably should be fully consolidated into UBI would likely be food and nutrition assistance ($108 billion), wage subsidies ($72 billion), child tax credits ($56 billion), temporary assistance for needy families ($17 billion), and the home mortgage interest deduction (which mostly benefits the wealthy anyway, at a cost of at least $70 billion per year). That’s $543 billion spent on UBI instead of all the above, which represents only a fraction of the full list, none of which need be healthcare or education.

<continues>

FFC Mariner

Well-Known Member

Interesting concept but anyone want to hazard a guess at how the free market capitalist elites feel about it?

dibo

Well-Known Member

So what’s the true cost?

The true net cost of UBI in the US is therefore closer to an additional tax revenue requirement of a few hundred billion dollars — or less — depending on the many design choices made, and there exists a variety of ideas out there for crossing such a funding gap in a way that many people might prefer, that would also treat citizens like the shareholders they are (virtually all basic research is taxpayer funded), and that could even reduce taxes on labour by focusing more on capital, consumption, and externalities instead of wages and salaries. Additionally, we could eliminate the $540 billion in tax expenditures currently being provided disproportionately to the wealthiest, and also some of the $850 billion spent on defence.

Universal basic income is thus entirely affordable and essentially Milton Friedman’s negative income tax in net outcome (and he himself knew this), where those earning below a certain point are given additional income, and those earning above a certain point are taxed additional income. UBI does not exist outside the tax system unless it’s provided through pure monetary expansion or extra-governmental means. In other words, yes, Bill Gates will get $12,000 too but as one of the world’s wealthiest billionaires he will pay far more than $12,000 in new taxes to pay for it. That however is not similarly true for the bottom 80% of all US households, who will pay the same or less in total taxes.

To some, this may sound wasteful. Why give someone money they don’t need, and then tax their other income? Think of it this way: is it wasteful to put seat belts in every car instead of only in the cars of those who have gotten into accidents thus demonstrating their need for seat belts? Good drivers never get into accidents, right? So it might seem wasteful. But it’s not because we recognize the absurd costs of determining who would and wouldn’t need seat belts, and the immeasurable costs of being wrong. We also recognize that accidents don’t only happen to “bad” drivers. They can happen to anyone, at any time, purely due to random chance. As a result, seat belts for everyone.

The truth is that the costs of people having insufficient incomes are many and collectively massive. It burdens the healthcare system. It burdens the criminal justice system. It burdens the education system. It burdens would-be entrepreneurs, it burdens both productivity and consumer buying power and therefore entire economies. The total cost of all of these burdens well exceeds $1 trillion annually, and so the few hundred billion net additional cost of UBI pays for itself many times over. That’s the big-picture maths.

The real effects on motivation

But what about people then choosing not to work? Isn’t that a huge burden too? Well that’s where things get really interesting. For one, conditional welfare assistance creates a disincentive to work through removal of benefits in response to paid work. If accepting any amount of paid work will leave someone on welfare barely better off, or even worse off, what’s the point? With basic income, all income from paid work (after taxes) is earned as additional income so that everyone is always better off in terms of total income through any amount of employment — whether full time, part time or gig. Thus basic income does not introduce a disincentive to work. It removes the existing disincentive to work that conditional welfare creates.

Fascinatingly, improved incentives are where basic income really shines. Studies of motivation reveal that rewarding activities with money is a good motivator for mechanistic work but a poor motivator for creative work. Combine that with the fact that creative work is to be what’s left after most mechanistic work is handed off to machines, and we’re looking at a future where increasingly the work that’s left for humans is not best motivated extrinsically with money, but intrinsically out of the pursuit of more important goals. It’s the difference between doing meaningless work for money, and using money to do meaningful work.

Basic income thus enables the future of work, and even recognizes all the unpaid intrinsically motivated work currently going on that could be amplified, for example in the form of the $700 billion in unpaid work performed by informal caregivers in the US every year, and all the work in the free/open source software movement (FOSSM) that’s absolutely integral to the internet.

There is also another way basic income could affect work incentives that is rarely mentioned and somewhat more theoretical. UBI has the potential to better match workers to jobs, dramatically increase engagement, and even transform jobs themselves through the power UBI provides to refuse them.

A truly free market for labour

How many people are unhappy with their jobs? According to Gallup, worldwide, only 13% of those with jobs feel engaged with them. In the US, 70% of workers are not engaged or actively disengaged, the cost of which is a productivity loss of around $500 billion per year. Poor engagement is even associated with a disinclination to donate money, volunteer or help others. It measurably erodes social cohesion.

At the same time, there are those among the unemployed who would like to be employed, but the jobs are taken by those who don’t really want to be there. This is an inevitable result of requiring jobs in order to live. With no real choice, people do work they don’t wish to do in exchange for money that may be insufficient — but that’s still better than nothing — and then cling to that paid work despite being the “working poor” and/or disengaged. It’s a mess.

<continues>

dibo

Well-Known Member

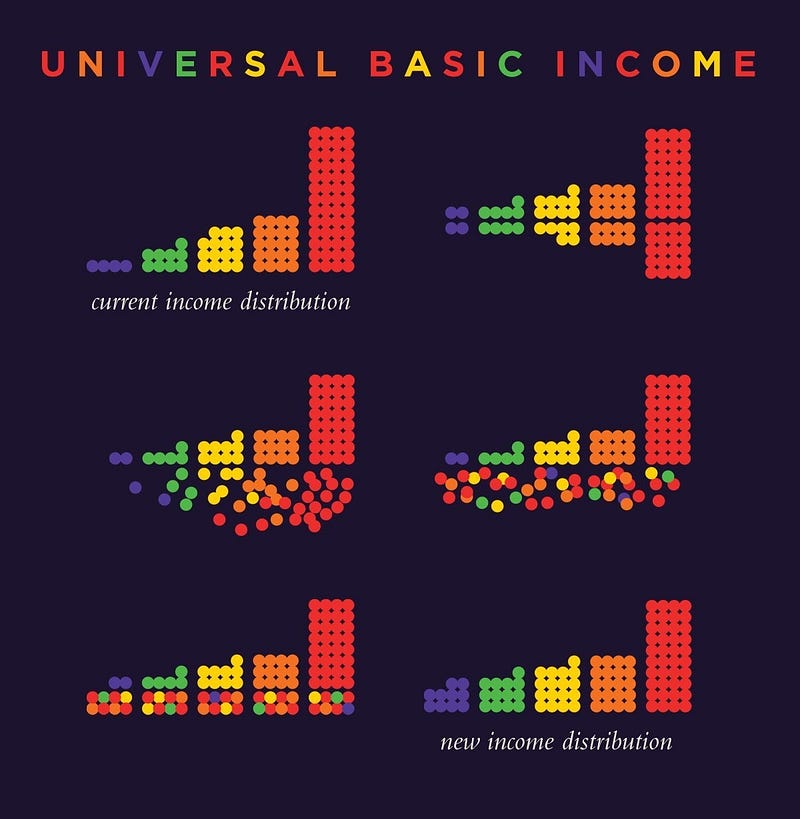

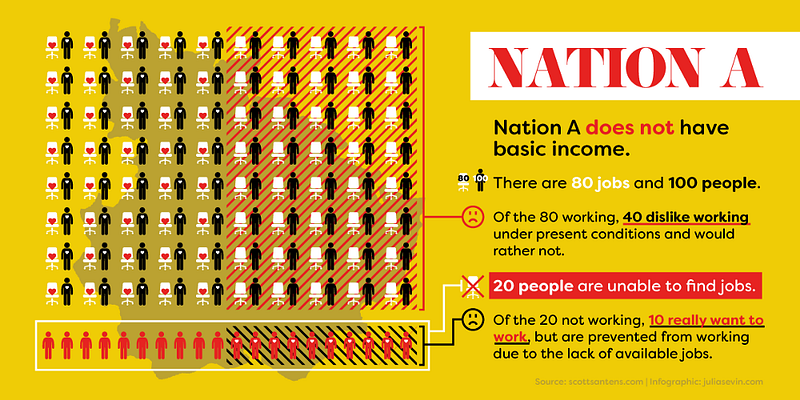

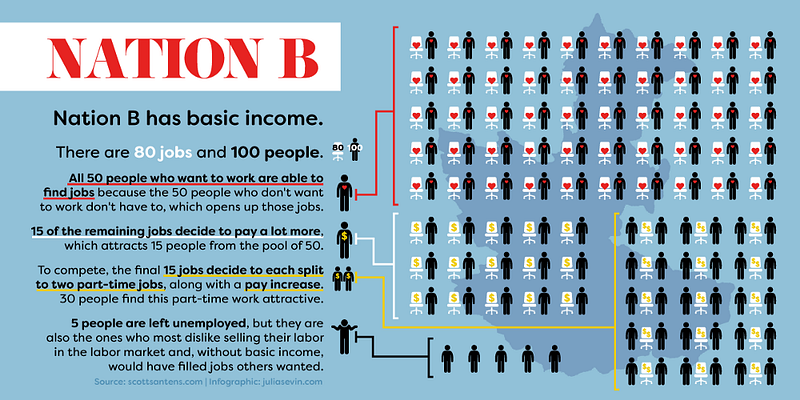

Basic income — in 100 people

Take an economy without UBI. We’ll call it Nation A. For every 100 working-age adults there are 80 jobs. Half the work force is not engaged by their jobs, and half again as many are unemployed with half of them really wanting to be employed, but, as in a game of musical chairs, they’re left without a chair.

Basic income fundamentally alters this reality. By unconditionally providing income outside of employment, people can refuse to do the jobs that aren’t engaging them. This in turn opens up those jobs to the unemployed who would be engaged by them. It also creates the bargaining power for everyone to negotiate better terms. How many jobs would become more attractive if they paid more money or required fewer hours? How would this reorganizing of the labour supply affect productivity if the percentage of disengaged workers plummeted? How much more prosperity would that create?

Consider now an economy with basic income. Let’s call it Nation B. For every 100 working age adults there are still 80 jobs, at least to begin with. The disengaged workforce says “no thanks” to the labour market as is, enabling all 50 people who want to work to do the jobs they want. To attract those who demand more compensation or shorter work weeks, some employers raise their wages. Others reduce the required hours. The result is a transformed labour market of more engaged, more employed, better paid, more productive workers. Fewer people are excluded, and there’s perhaps more scope for all workers to become self-employed entrepreneurs.

Simply put, a basic income improves the market for labour by making it optional. The transformation from a coercive market to a free market means that employers must attract employees with better pay and more flexible hours. It also means a more productive work force that potentially obviates the need for market-distorting minimum wage laws. Friction might even be reduced, so that people can move more easily from job to job, or from job to education/retraining to job, or even from job to entrepreneur, all thanks to more individual liquidity and the elimination of counter-productive bureaucracy and conditions.

Perhaps best of all, the automation of low-demand jobs becomes further incentivized through the rising of wages. The work that people refuse to do for less than a machine would cost to do it becomes a job for machines. And thanks to those replaced workers having a basic income, they aren’t just left standing in the cold in the job market’s ongoing game of musical chairs. They are instead better enabled to find new work, paid or unpaid, full-time or part-time, that works best for them.

Like a game of musical chairs — with robots

The tip of a big iceberg

The idea of basic income is deceivingly simple sounding, but in reality it’s like an iceberg with far more to be revealed as you dive deeper. Its big picture price tag in the form of investing in human capital for far greater returns, and its effects on what truly motivates us are but glimpses of these depths. There are many more. Some are already known, like the positive effects on social cohesion and physical and mental health as seen in the 42% drop in crime in Namibia and the 8.5% reduction in hospitalizations in Dauphin, Manitoba. Debts tend to fall. Entrepreneurship tends to grow. Other effects have yet to be discovered by further experiments. But the growing body of evidence behind cash transfers in general point to basic income as something far more transformative to the future of work than even its long history of considerationhas imagined.

It’s like a game of Monopoly where the winning teams have rewritten the rules so players no longer collect money for passing Go. The rule change functions to exclude people from markets. Basic income corrects this. But it’s more than just a tool for improving markets by making them more inclusive; there’s something more fundamental going on.

Humans need security to thrive, and basic income is a secure economic base — the new foundation on which to transform the precarious present, and build a more solid future. That’s not to say it’s a silver bullet. It’s that our problems are not impossible to solve. Poverty is not a supernatural foe, nor is extreme inequality or the threat of mass income loss due to automation. They are all just choices. And at any point, we can choose to make new ones.

Based on the evidence we already have and will likely continue to build, I firmly believe one of those choices should be unconditional basic income as a new equal starting point for all.

Originally published at weforum.org.

dibo

Well-Known Member

EDIT: Source: https://medium.com/world-economic-f...l-have-a-basic-income-7177d5b339ec#.ge7kvdvcb

JoyfulPenguin

Well-Known Member

Online statistics

- Members online

- 21

- Guests online

- 542

- Total visitors

- 563

Latest posts

-

-

-

NRL Chat – 80 Minutes of Sideways Hand-Egg Flinging & Human Collision Testing

- Latest: Capn Gus Bloodbeard

-